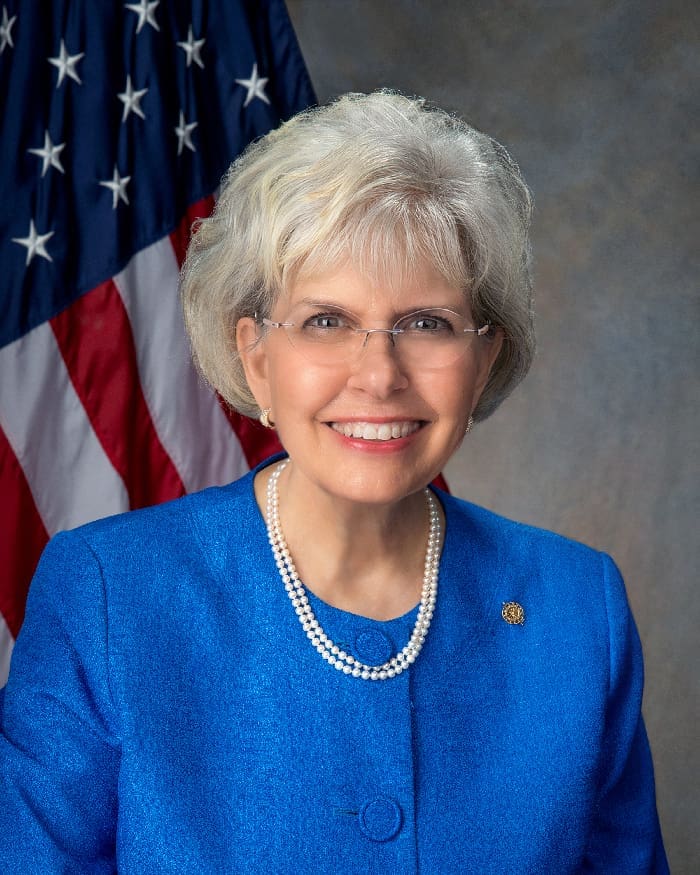

By Carolyn Newcomer Ketchel

I often have constituents ask me how can we spend money repairing a park or buying an office building but not repair Eglin Parkway between Shalimar bridge and Hwy 98? I will attempt to answer this question.

First let me write that your county commission is as frustrated as you with the deplorable condition of Eglin Parkway. This project is the sole responsibility of the Florida Department of Transportation (FDOT). If the roadway was under the authority of the county, we would have re-paved Eglin Parkway long ago. Our voices have been heard at FDOT. This state road can only be repaired by FDOT. If you are as concerned as we are about this project, I ask you to Please contact: Ian Satter, Public Information Director for FDOT, 850-330-1205, with your concerns.

One of the first things you learn about being a County Commissioner is that there are over 100 different revenue funds within the county budget. However, each fund has its own set of rules designated by Federal, State or Local Law, and, generally, one cannot be co-mingled with another. Let’s consider the Tourism Development Tax.

The Tourist Development Tax is payable at a rate of 6% (six pennies per dollar) on all overnight stays in short-term rentals (six months or less) in Okaloosa County. Short-term overnight rentals include hotels, motels, resort motels, apartments, apartment motels, rooming houses, mobile home parks, recreational vehicle parks, condominiums, condominium hotels, timeshare resorts, residential dwellings or campgrounds.

Okaloosa County has benefited from the “Bed Tax” in so many ways. Marler Park, Turtle Patrol, Lifeguards, beach sweeping, east pass inlet dredging, Women Veterans Park and the new underwater camera at the Okaloosa Pier (visit https://bit.ly/LiveOkaloosaPierCam) are wonderful examples, as well as the Bridge-to-Bridge Path on Highway 98 between Brooks Bridge and Destin Bridge. The county has bought several beach front properties in Destin for public use, as well as waterfront properties in Mary Esther, Shalimar, Cinco Bayou and Fort Walton Beach. The county has also purchased larger regional acreage in the north Crestview, Baker and Dorcus communities, and we are renovating the Fairgrounds (not known as Rigdon Center) with these funds.

The Florida Statute 125.0104 permits the Board of County Commissioners of Okaloosa County to levy Tourist Development Tax (TDT), and Chapter 20 Article II, Sections 71-78 of the Okaloosa County Ordinances created the Tourist Development Council, established the initial tax rate collection, and identified the special taxing districts within Okaloosa County.

Each penny of the six pennies collected is designated by Florida Statue and can only be spent on the areas designated within the statue.

Let’s examine the use and designation and use of each penny known as the Bed Tax:

First through third pennies

Revenues from the first three cents of the TDT can be used for the following purposes:

Facility construction and operation: Acquiring, building, or maintaining publicly owned and operated convention centers, stadiums, arenas, auditoriums, aquariums, and museums. This may also include zoological parks.

Tourism promotion and advertising: Funding the promotion and advertisement of tourism, including funding for convention bureaus and tourist information centers.

Beach and shoreline maintenance: Financing beach improvement, maintenance, erosion control, and re-nourishment.

Fourth penny

An additional one-cent tax may be levied for specific purposes, often related to special projects. These funds can be used for:

Professional sports facilities: Paying the debt on bonds used for professional sports facilities or spring training facilities.

Convention center operations: Covering operating costs for convention centers that were financed with tourist tax revenue.

Tourism advertising: Promoting and advertising tourism.

Fifth penny

This additional penny is often used for the following:

Professional sports facilities: Paying the debt on bonds used for constructing professional sports facilities or spring training facilities.

Convention centers: Paying the debt service on bonds for a convention center.

Tourism promotion: Advertising and promoting tourism.

Sixth penny

A county with a high tourism impact (generally with over $600 million in TDT sales) may impose a sixth cent with referendum approval. This penny can be used for purposes similar to the first three cents, including:

High tourism impact uses: Supporting projects related to a high tourism impact county, as specified in the statute.

Professional sports or spring training facility debt: Paying debt service on bonds for a new professional sports franchise facility or a retained spring training facility.

General tourism: Funding general tourism promotion and facilities.

Recent legislative changes

Recent legislation (effective July 1, 2025) has eliminated the requirement that at least 40% of tourist development tax revenue for capital projects be spent specifically on tourism marketing. This change allows counties greater flexibility in allocating TDT funds while still maintaining the focus on tourism-related infrastructure and promotion.

As you can see, there are many uses for the Bed Tax, but the pots of money cannot be co-mingled. One more important point for Okaloosa County. Since we are a coastal county that borders the Gulf, we can use up to 10% of our TDT revenue for public safety services.

Public Safety: In coastal counties, this revenue can reimburse expenses for law enforcement and emergency medical services needed to address increased tourism.

Lifeguards: Coastal counties often use these funds specifically for beach safety programs, including paying beach lifeguards.

I hope you have found this information to be helpful. These are the restrictions on one source of revenue, but there are many other sources in county government that are designated for a certain purpose and the Board of County Commissioners are restricted in their uses.

It is an honor to serve as your Okaloosa County Commissioner, District 2.

~ Carolyn Ketchel, Vice-Chairman 2024-2025

Contact Commissioner Ketchel at CKetchel@myokaloosa.com or 850-651-7105.